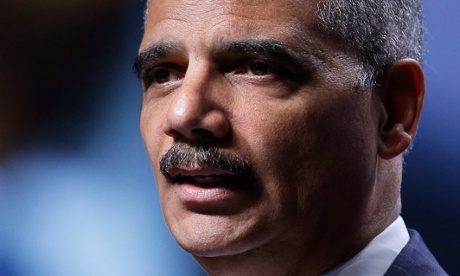

US attorney general says banks under investigation not 'too big to jail'

Eric Holder announced in video address that Justice Department pursuing criminal investigations of financial institutions

- theguardian.com, Monday 5 May 2014 12.03 EDT

The

US Justice Department is pursuing criminal investigations of financial

institutions that could result in action in the coming weeks and months,

US attorney general Eric Holder said in a video, adding that no company was "too big to jail."

The comments, made in a video posted on the Justice Department's website on Monday, came as federal prosecutors push two banks, BNP Paribas SA and Credit Suisse AG , to plead guilty to criminal charges to resolve investigations into sanctions and tax violations, respectively, according to people familiar with the probes.

While Holder did not name any banks, he said he is personally monitoring the ongoing investigations into financial institutions and is "resolved to seeing them through."

"I intend to reaffirm the principle that no individual or entity that does harm to our economy is ever above the law," Holder said in the video. "There is no such thing as 'too big to jail.'"

French bank BNP Paribas warned last week it faces fines from US authorities in excess of $1.1bn over allegations that it violated US sanctions against Iran and other countries.

The Swiss finance minister met Holder on Friday to discuss a US probe into Swiss banks that allegedly helped Americans evade US taxes, which includes Credit Suisse.

While units of financial institutions have agreed to plead guilty to breaking US criminal laws, such agreements have usually involved foreign subsidiaries who have little contact with US regulators.

Japanese units of UBS AG and Royal Bank of Scotland plc, for example, pleaded guilty in the past two years to resolve criminal charges that their traders manipulated the Libor benchmark interest rate.

A criminal conviction of an entity regulated in the United States could lead authorities to potentially revoke a charter or undertake other punitive measures.

Read More Here

The comments, made in a video posted on the Justice Department's website on Monday, came as federal prosecutors push two banks, BNP Paribas SA and Credit Suisse AG , to plead guilty to criminal charges to resolve investigations into sanctions and tax violations, respectively, according to people familiar with the probes.

While Holder did not name any banks, he said he is personally monitoring the ongoing investigations into financial institutions and is "resolved to seeing them through."

"I intend to reaffirm the principle that no individual or entity that does harm to our economy is ever above the law," Holder said in the video. "There is no such thing as 'too big to jail.'"

French bank BNP Paribas warned last week it faces fines from US authorities in excess of $1.1bn over allegations that it violated US sanctions against Iran and other countries.

The Swiss finance minister met Holder on Friday to discuss a US probe into Swiss banks that allegedly helped Americans evade US taxes, which includes Credit Suisse.

While units of financial institutions have agreed to plead guilty to breaking US criminal laws, such agreements have usually involved foreign subsidiaries who have little contact with US regulators.

Japanese units of UBS AG and Royal Bank of Scotland plc, for example, pleaded guilty in the past two years to resolve criminal charges that their traders manipulated the Libor benchmark interest rate.

A criminal conviction of an entity regulated in the United States could lead authorities to potentially revoke a charter or undertake other punitive measures.

Read More Here

No comments:

Post a Comment

Hello and thank you for visiting my blog. Please share your thoughts and leave a comment :)